As memory prices keep climbing, understanding AI-driven demand, US–China controls, and input costs is essential for procurement and engineering teams.

NY, UNITED STATES, January 26, 2026 /EINPresswire.com/ — January 2026— Market conditions in the DRAM and NAND sectors have shifted toward a renewed upswing, with pricing and availability signals changing rapidly. Recent market behavior has included quotes that change within short intervals, lead times that extend with limited notice, and prioritization of data-center-related memory products in supplier allocation. Industry observations indicate that the current pricing upswing is being amplified by three reinforcing forces: (1) AI and cloud infrastructure demand pulling capacity toward high-margin server DRAM and enterprise SSDs, (2) geopolitics and export controls adding friction and uncertainty to global supply, and (3) input costs—including precious metals used in packaging and interconnects—adding an additional layer of pressure.

For companies whose products depend on memory components—including phones and PCs, industrial controllers, networking equipment, and increasingly vehicles—the business challenge extends beyond unit price to continuity: maintaining build schedules when availability is uncertain and pricing resets faster than internal purchase approvals.

The sections below summarize key market drivers, their operational implications across industries, and practical procurement and engineering strategies commonly used to reduce risk during volatile cycles.

1) What’s driving the memory price surge?

Memory is cyclical by nature, but the current cycle has a distinctive shape: supply discipline on the manufacturing side colliding with a step-change in AI infrastructure demand.

1.1 AI and cloud are absorbing bits, not just units

In memory markets, the critical variable is “bit demand” (total bits of DRAM/NAND required), not only how many modules ship. AI training and inference clusters require large DRAM footprints per server and rapidly expanding storage layers for datasets, checkpoints, and logs.

TrendForce has stated that North American cloud service providers (CSPs) are accelerating investments in AI infrastructure and that this is tightening NAND supply as vendors prioritize enterprise products and profitability, pushing prices upward across product lines.

A similar dynamic has been observed in DRAM. TrendForce’s late-2025 DRAM commentary referenced stronger server DRAM contract pricing and raised expectations for conventional DRAM pricing, citing CSP expansion and higher DRAM capacity per server as high-performance architectures spread.

This market structure implies that pricing can rise even when PC or smartphone demand is only moderate, if AI infrastructure becomes the marginal buyer and suppliers optimize margins through product mix and controlled output. Financial coverage has echoed the “AI-driven memory supercycle” framing, emphasizing tight supply and memory makers’ pricing power as HBM and server demand expands.

1.2 Capacity is being allocated, not simply expanded

In prior cycles, producers often added capacity aggressively and later faced oversupply. In the current cycle, major suppliers have been more cautious about flooding the market. When supply is tight, wafers and packaging capacity can be allocated toward products with higher returns (HBM, server DDR5, enterprise SSDs). TrendForce’s NAND bulletin for January 2026 described a “super cycle” shaped by AI demand and supplier pricing control, with structural shortages emerging as sellers prioritize enterprise lines.

This allocation effect creates a common procurement challenge: shortages may not appear across “memory in general,” but rather in the exact density, speed grade, or endurance class already qualified. It also increases substitution pressure, requiring consideration of alternate densities, vendors, or form factors—each carrying engineering and validation costs.

1.3 Geopolitics and export controls add friction

Policy is a second amplifier. The United States has progressively tightened export controls aimed at advanced computing and semiconductor manufacturing items, with rule updates in 2022 and 2023 and continued enforcement emphasis. BIS resources summarize these rules and their intent.

Separately, the Congressional Research Service (CRS) has outlined how U.S. export controls are intended to restrict the PRC’s access to advanced semiconductor technology and related AI computing capability.

While not every memory part is categorized as “advanced computing,” memory manufacturing is tied to global toolchains and materials. Controls and licensing requirements can slow equipment upgrades, constrain tool shipments, and add uncertainty to capacity plans—particularly for leading-edge nodes and advanced packaging that also support HBM and enterprise products. Even the expectation of tighter rules can contribute to demand being pulled forward, amplifying short-term pressure.

A related knock-on effect can occur when one region’s suppliers are constrained and other suppliers inherit more demand than planned capacity can absorb, shifting negotiating leverage toward sellers.

1.4 Precious metals and interconnect costs: not the main driver, but a real layer

Attributing memory pricing primarily to gold or silver would be misleading; wafer costs, yields, and bit supply are typically larger levers. However, precious metals can matter in packaging and interconnects, and volatility becomes more relevant in tight cycles when each cost component is scrutinized.

Texas Instruments has documented, in a manufacturing context, that rising gold prices were a factor motivating the industry’s move toward copper wire bonding, describing copper as a hedge against rising gold prices and supply constraints.

Gold prices in early 2026 have also been elevated relative to prior years; Trading Economics tracked gold near recent highs in January 2026 with large year-over-year increases.

For electronics manufacturers, higher costs in bonding wire, finishes, and certain packaging materials can contribute to higher assembly costs, and some of that cost can be reflected in component pricing—particularly when demand allows suppliers to hold firm on ASPs.

2) How the price surge affects different industries

2.1 Consumer electronics: BOM pressure and configuration churn

PC and smartphone manufacturers are sensitive to DRAM and NAND cost per GB. When SSD contract prices rise—TrendForce cited large quarter-on-quarter increases for client SSDs in early 2026—OEMs often face a choice: absorb costs, raise end prices, or adjust configurations (lower base storage, reduce DRAM in entry SKUs, or push “premium” tiers). Configuration changes can also add engineering workload: new firmware images, expanded QA matrices, and, in some cases, recertification.

2.2 Automotive: “quiet shortage” risk in 2026

Vehicles are increasingly memory-dense: infotainment, ADAS, and autonomy stacks rely on DRAM and fast storage. Market commentary in early 2026 highlighted the possibility of DRAM deficits driven by suppliers prioritizing data centers, which could pressure automotive supply chains.

Automotive programs are exposed to long qualification cycles, and switching memory can be more difficult than in consumer devices. As a result, earlier allocation planning and conservative inventory buffers may be more valuable in this segment.

2.3 Industrial and networking: lead-time uncertainty

Industrial OEMs often build long-lived products with stable BOMs, but purchase volumes may be smaller than hyperscale demand. When supply tightens, these buyers can become both price takers and allocation takers. The operational risk is often less about permanent unavailability and more about unpredictable lead-time swings that increase line-down risk. In these segments, fast and accurate inventory confirmation and partial-ship logistics can become more operationally important.

3) Practical strategies used to reduce risk (and their tradeoffs)

3.1 Early procurement and price locking (with guardrails)

The core approach is moving from spot buying to planned coverage. In tight markets, predictable demand can support more stable supply arrangements. Common options include:

· Quarterly or semi-annual coverage agreements for critical SKUs

· Blanket POs with scheduled releases

· Vendor-managed inventory(VMI) or consignment where feasible

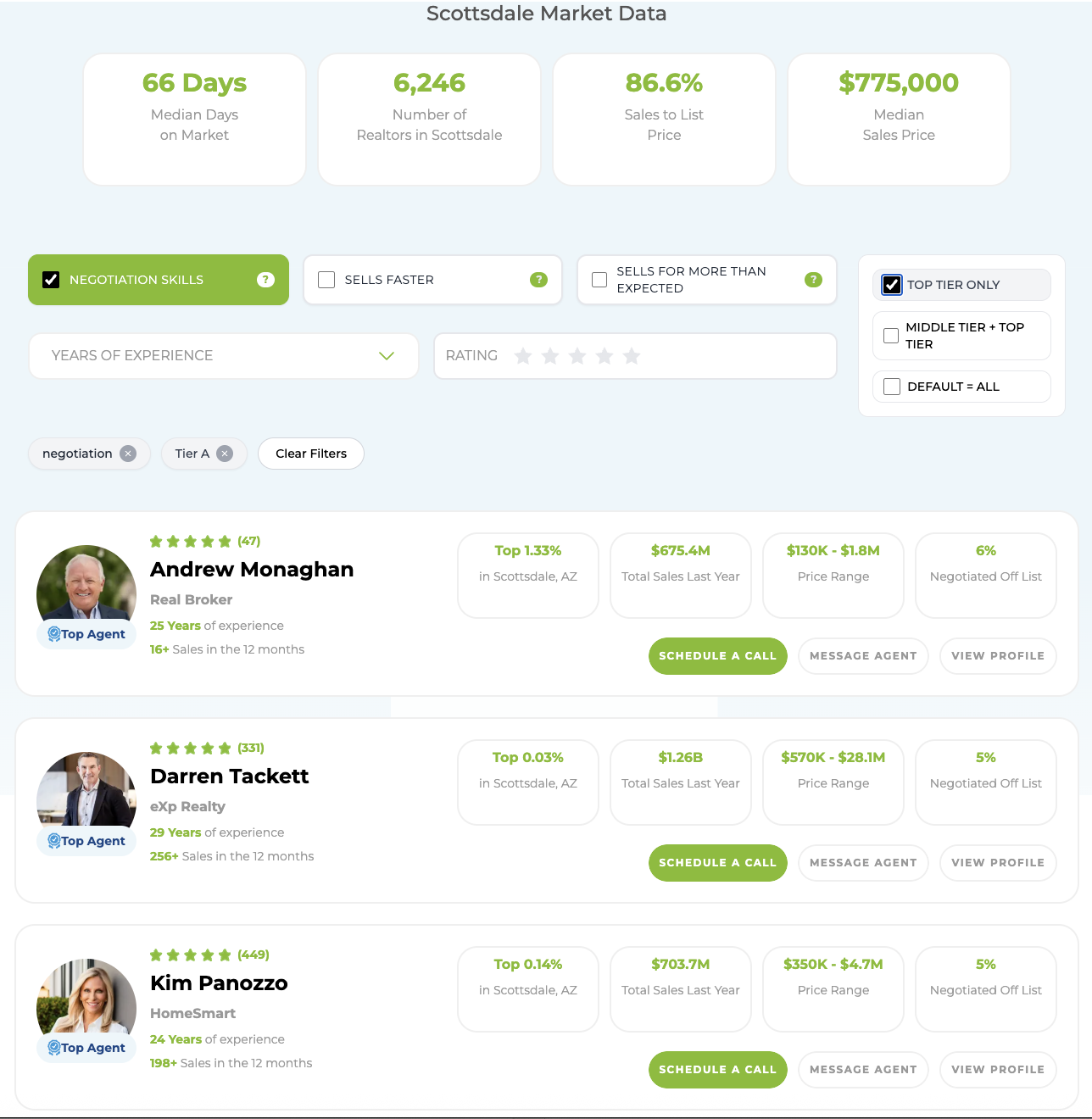

Guardrails matter because overbuying can backfire when the cycle turns. Tiered coverage is one practical method:

· Tier A (line-down critical, long qualification): 6–12 months coverage for stable SKUs

· Tier B (substitutable, shorter qualification): 3–6 months coverage

· Tier C (opportunistic): spot buying

Distributors may be used by some organizations to support inventory confirmation and fulfillment execution during volatile cycles. YY-IC (yy-ic.com) is one distributor cited for rapid inventory confirmation and fast shipment windows in distributor operations.

3.2 Supplier diversification: dual-source as a process

Supplier diversification typically requires structured execution because memory qualification can be demanding. Common elements include:

· Cross-vendor equivalency mapping (density, speed, timings, endurance class)

· Firmware/BIOS validation planning (especially for DDR generations and SSD controllers)

· Controlled pilot builds to validate alternates

· A documented swap playbook with test criteria and rollback triggers

The goal isrisk reduction and continuity when constraints affect a single supplier or region.

3.3 Design-to-availability: engineering levers to reduce dependency

Engineering can reduce supply risk without changing product goals by creating flexibility, for example:

· Using more common densities (avoiding niche bins)

· Allowing multiple DRAM speed grades if timing margins permit

· Qualifying at least two endurance classes in storage when workloads allow

· Preferring standards-based footprints that can accept multiple vendors

· Considering modular storage (e.g., replaceable SSD) vs. soldered options where environments allow

3.4 Predictive analytics: effective when paired with governance

Forecasting tools can help when connected to decisions. Common inputs include:

· Demand signals (sales forecast, program ramp dates)

· Supplier signals (lead times, allocation notices, contract price indices)

· Risk signals (policy events, logistics congestion, metal price spikes)

Governance practices often include a monthly “memory risk review,” with triggers such as lead-time increases or QoQ index moves that justify shifting items into longer coverage tiers. TrendForce’s DRAM/NAND market bulletins are examples of external signals many teams track for timing decisions.

3.5 Pricing mechanics: contract, spot, and allocation behavior

Memory often trades through a mix of contract pricing (large OEMs) and spot pricing (brokers, urgent buys). In upcycles, suppliers may prioritize strategic customers, steer demand toward preferred product mixes, or adjust quotes based on delivery windows. TrendForce commentary about suppliers controlling shipments and prioritizing enterprise applications illustrates how allocation signals can appear in market commentary.

Operational implications can include:

· Treating spot quotes as perishable (hours/days), not valid for weeks

· Separating “budget price” from “commit price” in planning

· Using external indices/bulletins to validate quote consistency with market conditions

· Negotiating on lead time, cancellation terms, and flexibility on speed grades/densities in addition to unit price

3.6 Managing quality risk: gray-market exposure controls

Price spikes can increase reliance on non-franchised channels, raising risks such as traceability gaps, storage-condition uncertainty, and potential remarked or recycled components. A basic control framework includes:

· Defining which SKUs may be sourced outside franchised channels and which may not

· Requiring traceability documents (lot codes, packing photos, CoC) for higher-risk parts

· Adding incoming inspection steps when business impact justifies (visual inspection, sample electrical tests, X-ray for suspect lots)

· Preferring partners able to document storage, handling, and chain of custody

Mini case example (anonymized)

A mid-size industrial OEM (10–20k units/month) experienced SSD lead-time extensions and price increases during a program ramp. The organization implemented (1) a six-month coverage position for two qualified SSD models, (2) validation of a lower-capacity fallback configuration that maintained performance requirements, and (3) pre-approval of a price band for urgent releases. The outcome was fewer line stoppages and faster response to market pricing moves.

4) Reading the next 12–18 months: indicators to monitor

4.1 CSP capex and AI server build-outs

TrendForce expects the server market to peak in 2026 as CSPs accelerate AI investments, supporting enterprise SSD demand and tightening supply. Continued strong CSP capex would sustain pressure on enterprise memory.

4.2 Product-mix decisions: DDR5 vs HBM vs conventional DRAM

TrendForce has discussed how supplier pricing and profitability can shift capacity preferences across DDR5 and HBM3e, affecting availability and prices in adjacent categories. Announcements related to allocation, packaging constraints, and yield ramps are commonly tracked.

4.3 Policy and export controls

BIS rule updates and enforcement actions can affect tool and technology flows, influencing where and how quickly capacity can expand. CRS analysis can provide context on policy direction.

4.4 Input costs and packaging constraints

Gold price levels and broader metal volatility are not primary drivers, but elevated metals can incentivize materials and process optimization. Packaging capacity and materials can become bottlenecks when advanced packaging is competing across multiple high-demand product lines.

5) Practical playbook for procurement and engineering teams

Step 1: Build a SKU criticality map (1 week)

· List top 20 memory SKUs by revenue exposure or line-down risk

· Tag each: lead time, alternates available, qualification effort, supplier concentration

Step 2: Set coverage targets (2–3 weeks)

· Apply Tier A/B/C coverage windows

· Convert targets into blanket orders or scheduled releases

Step 3: Qualify alternates (ongoing, start immediately)

· Select 1–2 alternates for each Tier A SKU

· Run pilot builds and create a documented swap playbook

Step 4: Establish quote-to-commit speed (immediate)

· Pre-approve spend ranges for Tier A items

· Define escalation paths for price moves above thresholds

· Use partners that can confirm inventory quickly and support fulfillment execution where required

Step 5: Track external signals (monthly)

· TrendForce DRAM/NAND bulletins and contract-price commentary

· Export-control updates via BIS/CRS

· Metal price volatility when packaging cost pressure is relevant

The current memory pricing upswing can be viewed as a system effect: AI infrastructure demand pulls bit supply toward server DRAM and enterprise NAND, suppliers respond through allocation and pricing discipline, and geopolitics adds friction and uncertainty to capacity planning. Precious-metal volatility functions as an additional cost layer that can be more visible in packaging and interconnect decisions when prices spike.

In response, many organizations are moving from reactive spot buying toward structured playbooks that combine tiered coverage, engineered alternates, design-to-availability levers, and governance tied to external market signals. In that framework, specialized distributors—including YY-IC—are positioned as execution resources for inventory confirmation and fulfillment during volatile market conditions, rather than as the central subject of the announcement.

yyic

YY-IC

+86 180 0257 1668

email us here

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()